Automate Inventory Replenishment with Odoo to Reduce Stockouts and Holding Costs

Automating inventory replenishment in Odoo reduces stockouts and holding costs by matching supply to actual demand with minimal manual intervention. This article gives a practical 60–120 day implementation plan, an operational case study with measurable KPIs, and clear recommendations so mid-market distributors can free working capital and improve service levels within two quarters

Introduction

Inventory is both an asset and a liability: excess stock ties up cash, while shortages erode customer trust. Odoo’s procurement and inventory modules support rule-based replenishment, lead-time-aware reorder points, and automated purchase orders — capabilities that, when configured to real demand signals, reduce stockouts and lower holding costs. A disciplined rollout focuses on high-velocity SKUs, implements demand smoothing, and adds exception workflows for slow-moving items. With a pragmatic scope and monitored KPIs, teams typically see measurable reductions in stockouts and Days Inventory Outstanding (DIO) within two quarters.

Case in point

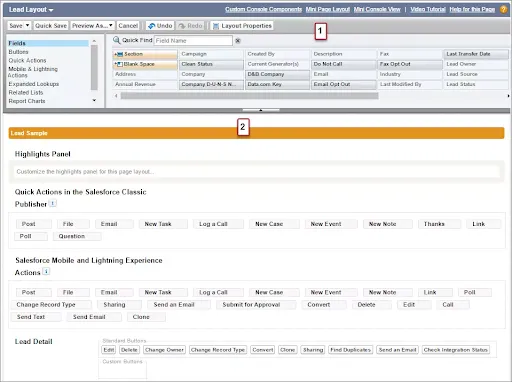

A regional electronics distributor with $22M annual revenue and roughly 2,500 SKUs automated replenishment in a 10-week program. Week 1–2 covered discovery and ABC/XYZ segmentation; week 3–6 implemented reorder rules and vendor lead-time profiles for the top 400 SKUs (accounting for 75% of volume); week 7–10 focused on exception handling and user training.

Concrete actions included enabling Odoo’s reordering rules with minimum quantity and maximum quantity tied to historical daily usage and supplier lead times, applying safety stock calculated as lead-time demand * service-level factor, and activating periodic scheduler runs every 24 hours to generate RFQs and purchase orders automatically. The team implemented a buffer reduction program for slow-moving SKUs and a prioritized alert queue for items with supplier reliability <85%.

During the initial 90 days the distributor saw measurable improvements: service level (on-time, in-full) for prioritized SKUs rose from 86% to 95% and stockouts for those SKUs fell by 72%. DIO decreased from 68 days to 49 days for the prioritized cohort, freeing working capital equivalent to approximately $450k within six months. Purchase order lead-time variance dropped by 30% after enforcing supplier lead-time profiles and automated reorders, which reduced rush purchasing and expedited shipping costs.

What to implement / Recommendations

- Segment SKUs using ABC (revenue) and XYZ (demand variability) and automate replenishment for the top revenue/velocity cohort first.

- Configure accurate supplier lead-time profiles and use lead-time demand to calculate reorder points rather than fixed rules.

- Set safety stock based on desired service level and lead-time variability, and review monthly for seasonal items.

- Run Odoo’s scheduler daily and route auto-generated RFQs to preferred vendors with configurable approval thresholds.

- Implement exception alerts for supplier reliability, sudden demand spikes, and low-turn SKUs to prevent blind automation.

- Integrate sales forecasts and open orders into the replenishment engine via a demand feed to avoid double-counting.

- Create an approval matrix for high-value orders (e.g., >$5k) to balance automation with cost control.

- Train warehouse and purchasing teams with short SOPs and a 30-day hypercare period post-launch.

For owners evaluating investments

Owners should prioritise automation where holding costs and stockout risk materially affect margin or customer retention. For many mid-market distributors, focusing on the top 20–30% of SKUs by value yields most of the financial benefit without a full catalog overhaul.

Choose between an in-house configuration and a partner-led project based on internal ERP expertise and urgency: a vendor partner accelerates delivery and reduces implementation risk but increases short-term cost. If working capital is constrained, expect automation to unlock cash within two to six months for prioritized items.

Expected outcome

With focused implementation, organizations can expect a service-level improvement of 6–12 percentage points for prioritized SKUs and stockout reductions in the range of 50–75% within three months of go-live. DIO typically falls by 15–30% for automated cohorts, producing measurable working capital release within one to two quarters.

Operational benefits include fewer rush orders, reduced expedited freight spend, and lower month-end reconciliation effort; these gains commonly recover implementation costs within 6–12 months for mid-market operations. Over time, automated replenishment provides more predictable supplier relationships and enables strategic sourcing decisions informed by cleaner lead-time and fill-rate data.

Enjoyed the article? Follow our LinkedIn newsletter for more insights — subscribe here.