Launch CRM Migration Playbook This Month to Cut Time to Value

A focused CRM migration playbook reduces time-to-value by combining tight scope, data hygiene, and staged cutovers. This article outlines a 90-day blueprint for discovery, data mapping, pilot, and go-live, plus measurable KPIs and tradeoffs owners should consider to capture forecast accuracy, user adoption, and cash-flow benefits within two quarters.

Introduction

CRM migrations routinely fail because teams treat them as purely technical projects instead of business transformations. A pragmatic playbook treats data, processes, and people equally: scope the highest-value sales motions, clean master records, map essential fields, and run a confined pilot that proves the business case. When executed in a tight 60–90 day cadence, organizations can show measurable improvements in time-to-first-value, forecast reliability, and sales productivity within two quarters while minimizing revenue disruption at cutover.

Case in point

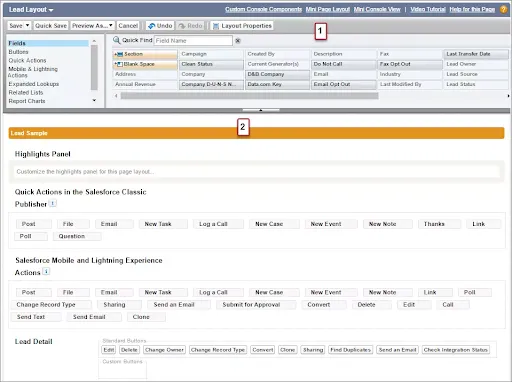

A mid-market services firm with $30M ARR and a legacy CRM ran a 12-week migration to a modern CRM platform using a playbook approach. Week 1–2: discovery and process alignment, focusing on three prioritized use-cases — lead-to-opportunity routing, forecast accuracy, and renewal tracking. Week 3–6: data profiling and mapping; teams reduced duplicate contacts from 28% to 6% by enforcing match rules (email + company registration number) and trimming stale leads older than 18 months. Week 7–9: connector builds, automation configuration, and a two-week pilot with one sales pod (8 reps) covering 22% of weekly pipeline.

Concrete actions included: automated lead assignment rules, a simplified opportunity stage model (6 stages), email sync with activity capture, and reverse ETL to feed enriched records back to reporting. The pilot produced measurable wins: average lead-response time fell from 18 hours to 3 hours, conversion from lead-to-opportunity rose 22%, and the pilot group’s forecast variance narrowed by 20% relative to the control group in six weeks.

The cutover used a single weekend freeze and phased onboarding: target accounts moved first, high-velocity accounts followed after 72 hours, and the final decommissioning of the legacy CRM occurred at day 14 post-cutover. Post-launch, the company reclaimed approximately 0.8 FTE in admin effort and achieved first-month time-to-value in 30 days for the pilot cohort.

What to implement / Recommendations

- Prioritize use-cases that unlock revenue or reduce friction; limit initial scope to the top two sales motions.

- Run a 2-week data profiling phase to quantify duplicates, missing fields, and stale records before mapping.

- Define a single master customer key and deterministic merge rules to avoid post-migration remediation.

- Pilot with one sales pod for 4–6 weeks and instrument five KPIs for quick feedback.

- Use a weekend cutover with a clear freeze, rollback plan, and a 14-day hypercare window for exceptions.

- Automate integrations for lead routing, emailing, and billing reconciliation to eliminate manual touchpoints.

- Train via role-specific micro-sessions (30–60 minutes) and embed how-to cards inside the CRM for week-one adoption.

- Lock scope for the MVP and schedule successive quarters for lower-priority integrations.

For owners evaluating investments

Owners must choose between a rapid vendor-led implementation and in-house builds. Vendor-led deliveries shorten time-to-value and reduce internal risk but increase one-time and ongoing costs; in-house builds offer lower license spend but require significant engineering and project management capacity. If revenue disruption risk is high, prioritize a vendor or experienced integrator with a proven playbook.

Evaluate ROI by linking the migration to clear commercial KPIs — forecast variance reduction, incremental closed-won rate, and reclaimed admin hours. Require a 60–90 day checkpoint to validate assumptions before wider rollouts or additional integrations.

Expected outcome

With disciplined scope and a staged pilot, expect measurable outcomes within two quarters: lead-response time can drop 60–80% for prioritized flows, lead-to-opportunity conversion can improve by 15–30%, and forecast variance often tightens by 10–25% depending on baseline quality. Operationally, 0.5–1.5 FTEs of administrative work are typically reclaimed in mid-market teams due to automation and cleaner data.

Longer term, a successful migration creates a single source of truth that enables reliable RevOps, better attribution, and faster decision cycles; payback on moderate-scope migrations commonly occurs within 6–12 months when tied to revenue-impacting use-cases.

Enjoyed the article? Follow our LinkedIn newsletter for more insights — subscribe here.