Launch Data Hub Integrations This Month: Unify Customer Data for Faster Decisions

Unifying customer data through a focused Data Hub rollout delivers faster, more reliable decisions across sales, marketing, and finance. This article explains a pragmatic, month-first approach to connect core systems, enforce a master customer model, and operationalize data for RevOps — including concrete timelines, measurable KPIs, and the tradeoffs owners should weigh before committing budget.

Introduction

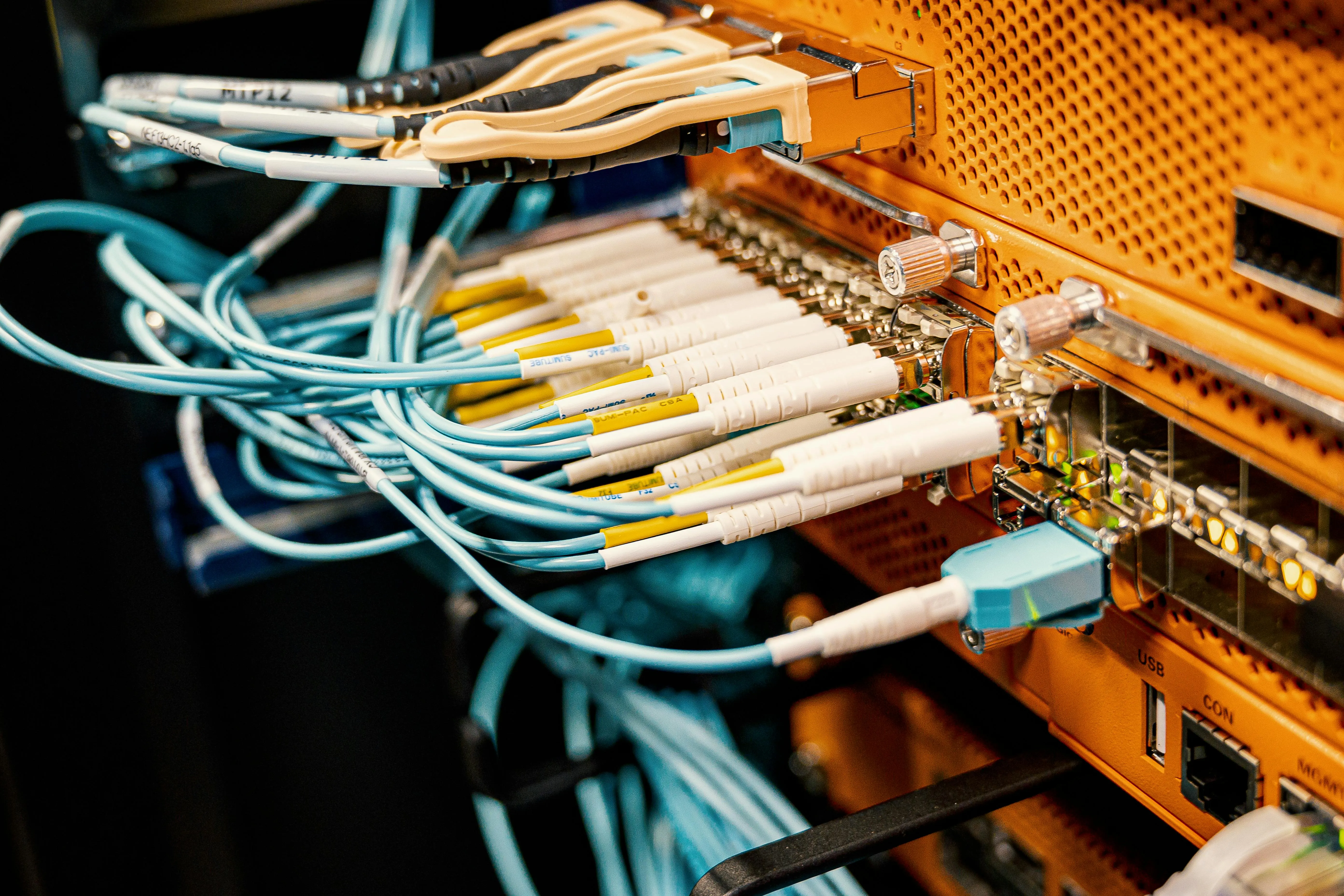

Many mid-market companies lose weeks of selling and forecasting accuracy to fragmented data: marketing cookies in one place, CRM records in another, billing in a third. A disciplined Data Hub integration program — executed with an emphasis on the highest-value sources this month — converts disparate signals into a single customer view that operations can act on immediately. The right scope and cadence reduce time-to-insight, shorten sales cycles, and deliver measurable uplifts in conversion and forecast reliability within two quarters.

Case in point

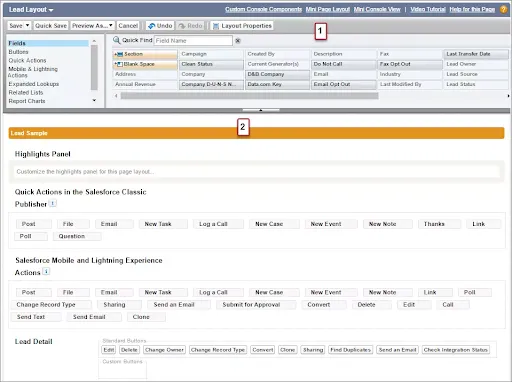

A 120-person B2B software firm launched a focused Data Hub integration program targeting three sources: the CRM (sales activity), marketing automation (MQLs), and billing (invoices). The team scoped the work for a 90-day sprint: 2 weeks of discovery and schema design, 6 weeks of connector builds and ingest pipelines, and 4 weeks for master data rules, QA, and reverse ETL to the CRM.

Concrete actions included: standardizing contact identifiers (email + corporate tax ID), creating deterministic merge rules, and deploying a near-real-time reverse ETL that pushed enrichment back to the CRM every 15 minutes. The initial ledger tracked 5 KPIs daily: duplicate rate, lead-to-opportunity time, forecast variance, time-to-close, and churn signals.

Within three months the duplicate contact rate fell from 17% to 3% and lead-to-opportunity time shrank from 9 days to 5 days. Forecast variance improved by 18% within two quarters because sales had consistent attribution and finance could reconcile billed revenue to pipeline signals. The vendor cost (SaaS connectors + engineering) paid back in nine months through recovered deals and reduced manual reconciliation.

What to implement / Recommendations

- Prioritize connectors by revenue impact; integrate systems that touch the top 30% of ARR first.

- Define a single master customer key before building pipelines to avoid downstream rework.

- Use incremental ingestion (CDC/streaming) where possible to enable near-real-time operationalization.

- mplement deterministic merge rules first and probabilistic matching only if business requires it.

- Push cleansed, enriched records back into CRM via reverse ETL so revenue teams act on the same data.

- Automate daily reconciliation reports between billing and CRM to surface anomalies within 24 hours.

- Protect privacy and compliance by design: encrypt PII and log data lineage for audits.

- Start with a 90-day MVP and schedule quarterly rollouts for lower-priority sources.

For owners evaluating investments

Owners must weigh build-versus-buy and timing. Buying a managed Data Hub and prebuilt connectors reduces time-to-value but increases SaaS spend; building in-house lowers recurring costs but requires engineering hours and longer delivery. For organizations with constrained engineering capacity and immediate revenue pressure, a commercial hub with a 60–90 day onboarding is usually the faster path to measurable impact.

Secondly, prioritise business use-cases, not technology. If the top use-case is forecast accuracy or churn detection, align integrations and reverse ETL to that metric first. Avoid “kitchen sink” projects that delay benefits and burn stakeholder confidence.

Expected outcome

When executed with tight scope and governance, expect measurable improvements within two quarters: duplicate contact rates reduced to single digits, lead-to-opportunity time cut by ~30–50%, and forecast variance improvement in the 10–25% range depending on baseline quality. Operational gains — fewer manual reconciliations and faster SLAs — typically free one to two FTEs worth of effort in finance and ops for mid-market firms.

Longer term, a unified hub becomes a platform: faster campaign personalization, cleaner analytics, and a reliable feed for AI models that drive next-best-action. The investment pays back through recovered revenue, lower churn, and reduced operational overhead; realistic organizations should plan for an 6–12 month payback window depending on scale and subscription costs.

Enjoyed the article? Follow our LinkedIn newsletter for more insights — subscribe here.