Automate Lead-to-Cash Workflows to Shorten Sales Cycles and Increase Revenue

End-to-end automation of lead-to-cash—connecting CRM, CPQ, contract management, billing, and collections—removes manual handoffs that slow deals and delay cash. This article demonstrates that a focused automation program targeting quote generation, contract execution, provisioning, and invoice automation typically shortens sales cycles and reduces DSO with measurable gains within two quarters.

Introduction

Manual steps between sales and finance create predictable friction: delayed quotes, approval bottlenecks, contract misalignment, and late invoicing that together extend sales cycles and inflate days sales outstanding (DSO). Automating the lead-to-cash pipeline converts those friction points into deterministic workflows—validated quotes, rule-driven approvals, electronic contract execution, automated provisioning, and instant invoice issuance. When implemented with robust data mapping and monitoring, automation produces faster order conversion, fewer billing disputes, and quicker cash collection, turning operational drag into measurable revenue acceleration and improved forecast reliability.

Case in point

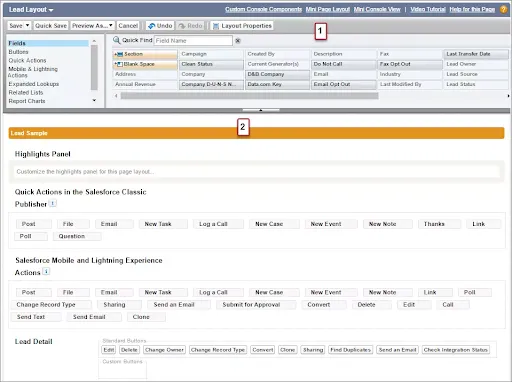

A mid-market SaaS provider with $40M ARR and a 120-day median sales cycle implemented a staged lead-to-cash automation over 16 weeks. Baseline issues included manual quote assembly (average 3 business days), paper signing cycles (10–14 days), and invoice timing lagging go-live by 5–7 days. The project prioritized four automations: CPQ-driven quote templates with embedded discount guardrails, automated approval routing with a 24-hour escalation SLA, e-signature integration tied to contract generation, and immediate billing triggers upon contract execution.

Implementation occurred in phased sprints: Weeks 1–4 standardized product catalog and pricing tiers; Weeks 5–8 integrated CPQ with CRM and contract generation; Weeks 9–12 connected e-signature and billing systems; Weeks 13–16 deployed collections automation and reporting. Each automation included telemetry to capture cycle times and exception rates.

Results were measurable. Within three months of go-live, average time to generate an approved quote dropped from 72 hours to 6 hours; median signature turnaround moved from 12 days to 28 hours; invoice issuance frequency aligned to contract execution, eliminating the typical 5–7 day billing delay. Sales cycle length contracted from 120 to 88 days (a 27% reduction) and DSO fell by 18 days, delivering immediate cash flow improvement. The finance team reduced ad hoc journal corrections by 65% and reclaimed ~120 staff-hours per month for strategic analysis.

What to implement / Recommendations

- Standardize product definitions, SKUs, and pricing tiers before automating to minimize exceptions and mapping errors.

- Implement CPQ templates with enforced discount and margin guardrails to remove discretionary pricing leaks.

- Automate approval routing with defined SLAs and escalation rules to prevent stalled quotes.

- Integrate contract generation with e-signature so signed contracts trigger provisioning and billing automatically.

- Configure billing triggers to issue invoices immediately upon contract signature and to push metadata to finance systems.

- Add collections automation that sends personalized reminders based on payment terms and routes exceptions to an agent only when thresholds are exceeded.

- Instrument each stage with rule IDs and metrics (time-to-quote, signature time, invoice lag, DSO) to measure the impact of individual automations.

- Pilot on two high-volume segments for 8–12 weeks, validate KPI changes, then scale incrementally.

For owners evaluating investments

Investment tradeoffs balance initial integration cost and change management against rapid cash acceleration and reduced manual workload. Organizations with higher ACV or subscription models typically see faster ROI because automation accelerates recurring billing and reduces churn from billing errors.

Choose a phased approach: prioritize automations that cut direct time-to-revenue (quote approvals, e-signature, invoice triggers) before expanding to softer benefits like advanced revenue recognition or complex billing scenarios. Vendors shorten delivery but add subscription costs; in-house builds allow flexibility but require longer delivery windows.

Expected outcome

Realistic outcomes within two quarters include a 20–35% reduction in sales cycle length for automated segments and a DSO reduction of 10–25 days depending on baseline billing delays. Revenue recognition and cash collection become more predictable, improving working capital and enabling reinvestment.

Operationally, finance and sales reclaim significant capacity—often 30–60% of time previously consumed by manual reconciliations and exception handling—allowing teams to focus on pricing optimization, credit policy, and customer success, which further compounds revenue gains.

Enjoyed the article? Follow our LinkedIn newsletter for more insights — subscribe here.